Deferred Share Bonus Scheme

Our Deferred Share Bonus Scheme (DSBS) is the deferred shares element of the International Executive Incentive Scheme (IEIS). If you are eligible, you will receive a conditional share award, granting you the right to receive a number of shares in British American Tobacco provided you still work with us at the end of a three year vesting period.

Here is how it works

The DSBS is awarded once a year and the number of shares awarded is based on your IEIS payout and the percentage of bonus deferral applicable to your pay grade.

If you’re unsure of the DSBS award percentage applicable to your pay grade, please consult your HRBP.

If you’re still employed by British American Tobacco at the end of the three year vesting period the award of shares will be transferred to you. You will then be able to keep, sell or transfer your shares.

If BAT cannot operate a share scheme in your country you will be granted phantom shares that payout in cash.

Am I eligible? |

You’re eligible for the DSBS as long as you’re a full time or part time permanent employee of British American Tobacco at Grade 38 or above and received an IEIS bonus.

How many conditional shares could I receive?

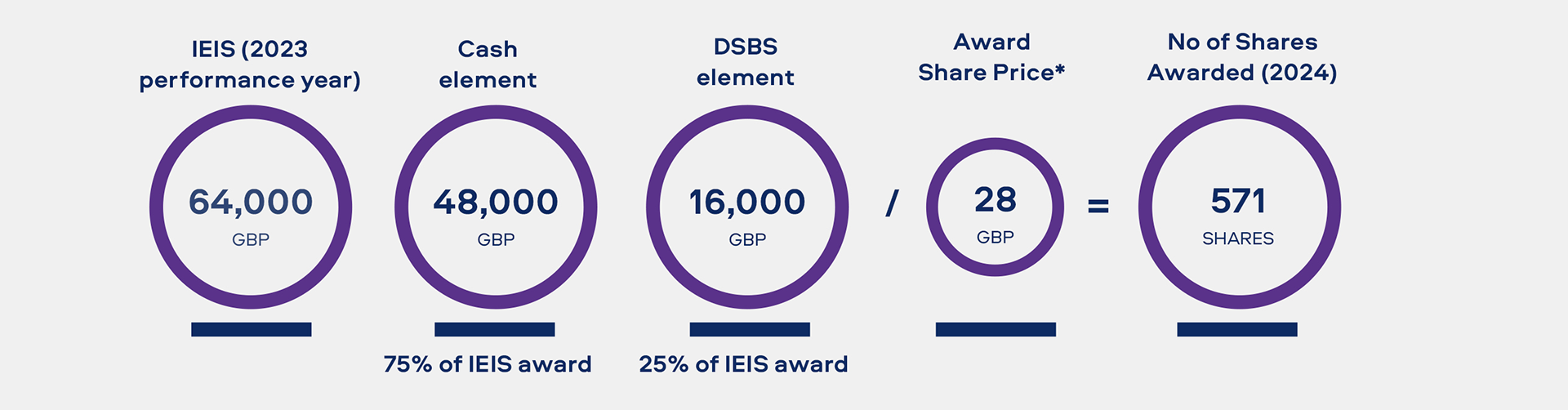

Let’s say your IEIS award is paid out 75% in cash and 25% in shares, we will divide the deferral element of your IEIS by the award share price.

Here’s how that might look:

*The award share price is the average BAT share price (derived from the LSE, JSE or NYSE as appropriate), over the three dealing days immediately preceding the award grant date.

At the end of the three year vesting period those 571 shares will carry a new monetary value, depending on the British American Tobacco share price at the time.

As an example:

Dividends |

Normally BAT will pay shareholders a dividend 4 times a year. You are eligible to a cash payment equivalent to the value of any dividends you would have received on your estimated net shares. Dividend equivalents will be paid to you via payroll on a quarterly basis during the three-year vesting period.

When will I receive my shares? |

You’ll receive your shares at the end of the three year vesting period (provided you still work for British American Tobacco).

Here is an example:

|

AWARD DATE March 2022 |

a |

VEST DATE March 2025 |

Will I have to pay tax? |

Depending on which country you’re in there will probably be some tax to pay when your shares vest.

In some cases BAT will be required to withhold taxes from your share income when your award vests. In others it’s your responsibility to declare and pay any taxes due via your personal tax return. Remember you may also have to pay some capital gains tax.

If you’re in any doubt about the tax consequences of receiving your share award we recommend you speak to an independent tax adviser.

What happens if I leave the company?

What happens to your DSBS award if you leave before the end of the three year vesting period depends on the reason your employment ended.

If you leave British American Tobacco due to:

Disability, ill-health or injury (as evidenced to the satisfaction of the Board)

A sale, transfer or winding up of the business

your award will vest in full, and the shares will be transferred to you as soon as practical after you leave.

If you leave for any other reason (including retirement, redundancy, resignation or dismissal):

Your unvested DSBS award will lapse unless the Board of Directors decide otherwise.