Performance Share Plan

Our Performance Share Plan (PSP, formerly known as the LTIP) is a way of incentivising our leaders to work towards achieving performance goals, with the promise of an award of shares in the company if those goals are met.

Here’s how it works

The PSP is a conditional share award, granting you the right to receive a number of shares in British American Tobacco. However it is conditional on the company achieving certain performance goals over three financial years, beginning on 1 January of the year of award.

The award is granted twice a year, usually in March and September (for new joiners or people recently promoted from a non-eligible grade). You will be notified by Computershare when you can log in to your account to find:

| The maximum number of shares you have been conditionally awarded |

| The performance conditions attached to the award |

If you’re still employed by British American Tobacco at the end of the three year vesting period the award of shares will be transferred to you. You will then be able to keep, sell or transfer your shares.

If BAT cannot operate a share scheme in your country you will be granted phantom shares that payout in cash.

Am I eligible? |

You’re eligible for the PSP as long as you’re a full-time or part-time permanent employee of British American Tobacco at Grade 40 and above on 1 January or 1 July of the year of award.

Don’t worry, you can still participate in the PSP if you are on international assignment, but the plan may work differently in different countries (you may receive a phantom award that pays out in cash instead of shares).

How many conditional shares could I receive?

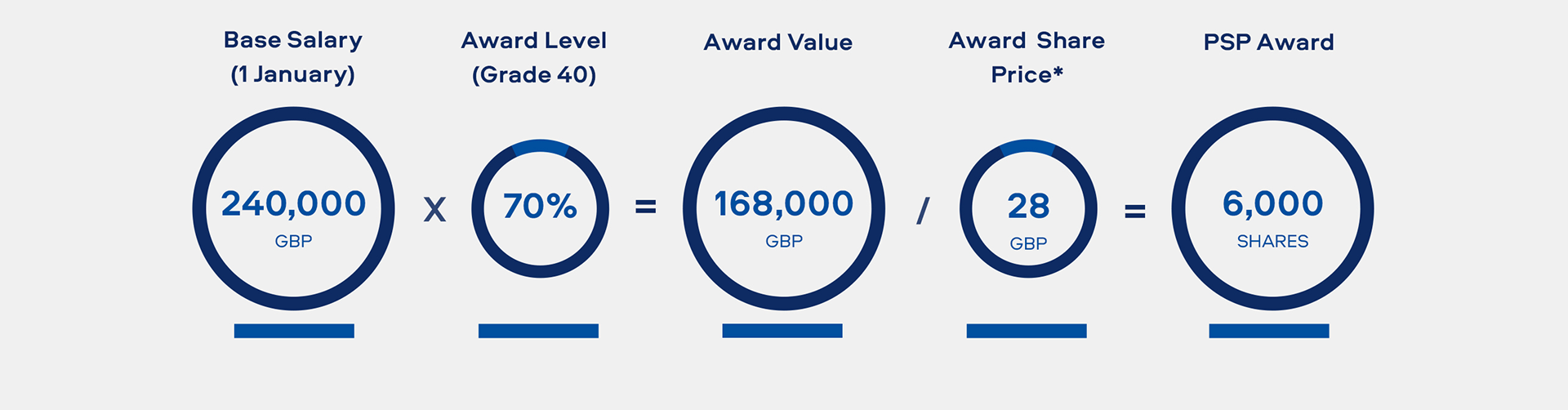

The maximum value of your award depends on your pay grade and base salary on 1 January or 1 July in the year the award is granted. We calculate it by multiplying your base salary by the relevant percentage. If you’re unsure of the PSP award percentage applicable to your pay grade, please consult your HRBP.

Here is an example:

So, if you receive an award of shares based on 70% of your basic salary we’ll divide that by the award share price to arrive at the potential number of conditional shares you may receive, subject to meeting the performance conditions over the three year vesting period.

*The award share price is the average BAT share price (derived from the LSE, JSE or NYSE as appropriate), over the three dealing days immediately preceding the award grant date.

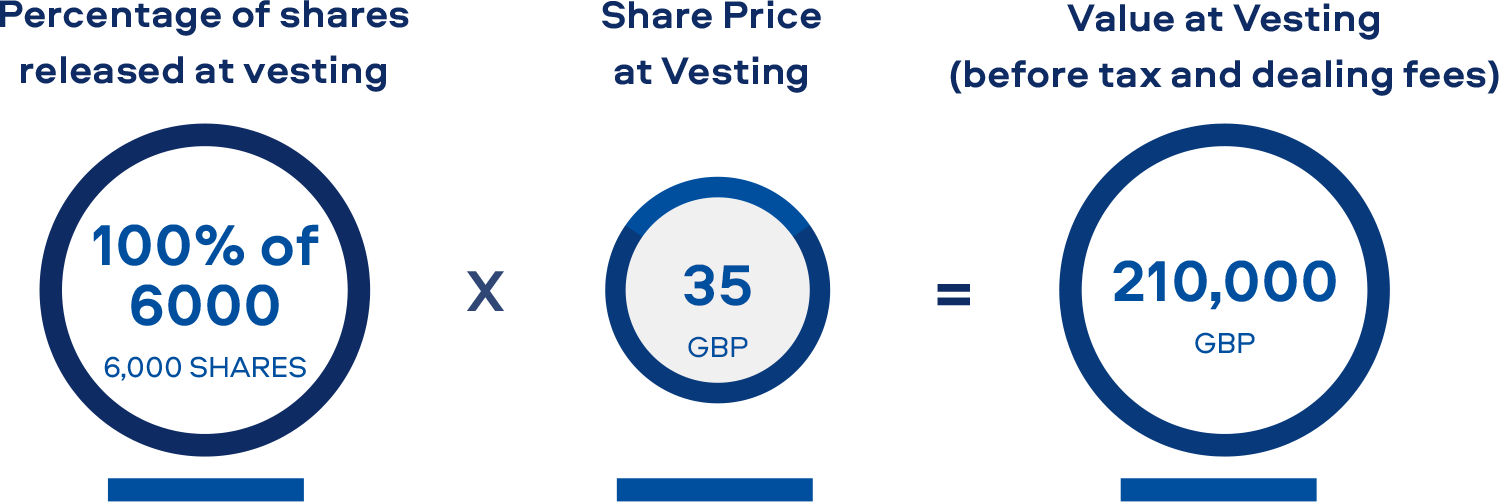

Depending on how the company performs over the performance period here’s how much your award might be worth under three different scenarios:

Scenario 1:

Depending on how the company performs over the performance period here’s how much your award might be worth under three different scenarios:

Scenario 2:

Depending on how the company performs over the performance period here’s how much your award might be worth under three different scenarios:

Scenario 3:

Dividends |

When your award vests you may also receive an additional cash payment. This will be equivalent to the value of any dividends you would have received on your vested shares during the vesting period. Dividend equivalents will be a one-time payment paid to you via payroll after the vesting date.

When will I receive my shares? |

As long as you’re still employed by British American Tobacco at the end of the three year vesting period then your award will vest and you’ll automatically receive some or all of your shares, depending on how we’ve performed against our targets. You don’t need to do anything yourself.

If you were granted any BAT LTIP award before 2020 (vested in March 2022 or earlier), your award will have been in the form of a stock option to buy BAT shares at no cost. This means you’ll still need to exercise any vested option in order to receive the underlying shares. Pre 2020 stock options can be exercised up to 7 years after vesting. Different rules apply to leavers.

Will I have to pay tax? |

Depending on which country you’re in there will probably be some tax to pay when your shares vest.

In some cases BAT will be required to withhold taxes from your share income when your award vests. In other cases it’s your responsibility to declare and pay any taxes due via your personal tax return. Remember you may also have to pay some capital gains tax.

If you’re in any doubt about the tax consequences of receiving your share award we recommend you speak to an independent tax adviser.

What happens if I leave the company?

If you stop working for British American Tobacco, what happens to your PSP award will depend on the reason your employment ended.

If you leave British American Tobacco due to:

Disability, ill-health or injury (as evidenced to the satisfaction of the Board)

A sale, transfer or winding up of the business

Your award will be pro-rated, based on the number of months you were employed by BAT during the performance period. Your pro rated award will still vest on the normal vesting date and will still depend on company performance over the entire three year performance period (this is known as “wait and see”). The “wait and see” rule does not apply to awards granted before 2020.

NB for pre-2020 LTIPs: Should you leave BAT for one of the above reasons you’ll have 6 months from leaving date to exercise your stock options before they lapse. If you resign from BAT, any unexercised stock options will lapse on your leaving date.

If you leave for any other reason (including retirement, redundancy, resignation or dismissal):

Your award (including any vested but unexercised options) will lapse unless the Board of Directors decides otherwise.