Sharesave

Our Sharesave scheme is a really straightforward savings plan which allows you to save a portion of your after tax salary every month. After a set period of time you can use those savings to buy shares in British American Tobacco at a 20% discounted rate. This is known as the option price.

Here’s how it works

The plan is simple:

STEP 01

Choose how much you want to save (between £10 and £500* per month) and for how long – three or five years. You can also choose to join two plans - one for three years and one for five years.STEP 02

Sign up during the invitation window, typically in March every year, you'll receive an email to let you know what to do. The money will be deducted from your net salary (after tax) every month and held in your personal Sharesave account for three or five years, depending on your plan.*you can save a maximum of £500 for all plans

At the end of the savings period, decide what to do with your savings pot.

STEP 03

Buy shares and keep themBuy shares in British American Tobacco Plc at the option price* and keep them. You will then be a shareholder. |

|

|

Buy shares and sell themBuy shares in British American Tobacco Plc at the option price* and sell them straight away, keeping any profit you’ve made. |

|

Take back all your savingsTake back all your savings as cash and spend or re-invest them as you wish. |

*The option price is a 20% discount off the market share price when you joined the plan.

In line with HMRC Sharesave bonus and interest payments, you’ll receive a bonus on your savings at maturity of the plan:

- if your plan term is 3 years, then you will receive a bonus equivalent to your monthly payment multiplied by 0.9 or

- if your plan term is 5 years, then you will receive a bonus equivalent to your monthly payment multiplied by 2.7.

For example: If you save £500 a month over a 3-year term, a bonus payment of £450 will be added. This means that your total savings over the period will be £18,450.

This amount is then used to calculate your options : £18,450/Option Price.

Further information can be found on the HMRC website.

If for any reason you need to pause your payments, you are allowed 12 payment breaks during your plan. The normal maturity date will be extended by a month for every missed payment. Please ensure you make up the missed payments directly with Computershare as payroll cannot make catch up payments on your behalf. In the event missed contributions exceed 12 months your Options will lapse.

Am I eligible? |

You can participate in the plan as long as you are working in the UK and have a UK contract during the invitation period.

If you’re a UK employee who is already part of another Sharesave scheme but you’re on assignment overseas during the invitation period, you won’t be able to sign up to a new plan. However, you can continue saving into any of your existing plans.

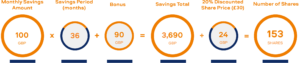

How many shares could I receive?

The number of shares you’ll be able to buy depends on a couple of important factors:

How much you choose to save each month, and;

The option price, set just before your savings contract begins

Here’s how this might look on a three year saving contract:

If the market share price is £35 at the end of your savings period, then your 153 shares will have a market value of £5,355. That’s a potential gain for you of £1,665.

To see how this example would look for a three-year saving contract under the 2024 plan,

please click here.

To see the example for plans prior to 2024, please click here.

Will I have to pay tax? |

Another great thing about Sharesave is that it’s a government recognised Save As You Earn (SAYE) scheme, so you won’t have to pay income tax when you receive your share option or when you buy your shares.

Remember though, you may have to pay capital gains tax when you come to sell your shares depending on your personal circumstances.

If you’re in any doubt about the tax consequences of receiving your share award we recommend you speak to an independent tax adviser.

What happens if I leave the company?

If you leave British American Tobacco due to:

You can either -

- Exercise your option to buy shares within six months of leaving, using the money in your savings account; or

- Continue saving for up to a further 6 months after leaving, thereby increasing the overall savings prior to exercising your options; or

- Take back your savings and spend them as you wish

You can either:

- Exercise your option to buy shares within six months of leaving, using the money in your savings account; or

- Take back your savings and spend them as you wish.

You can:

Take back your savings and spend them as you wish